The numbers are what they are because of decisions and events that actually occurred. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background. Still, you’ll likely see this equation pop up time and time again.

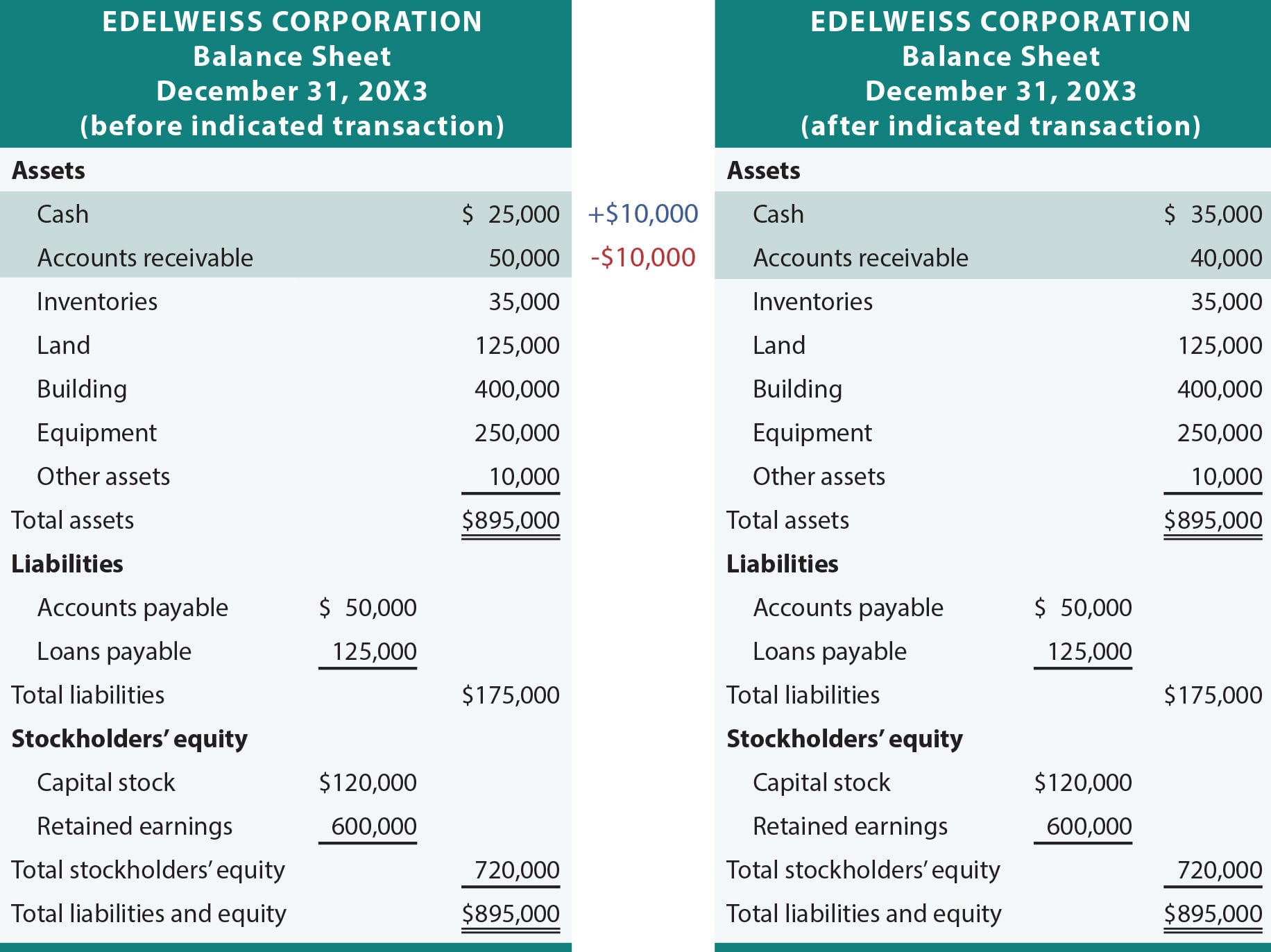

- In the above transaction, Assets increased as a result of the increase in Cash.

- Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

- The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation.

- In this example, take $2.395 billion and subtract $1.975 billion; the result is $420 million.

- Thus, the accounting equation is an essential step in determining company profitability.

Why is the accounting equation important?

This principle ensures that the Accounting Equation stays balanced. After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment. Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation. The company acquired printers, hence, an increase in assets. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash).

Current Assets

Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency. Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market. The Accounting Equation is a vital formula to understand and consider when it comes to the financial health of your business.

Calculating the change in assets of a company

In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change.

Impact of transactions on accounting equation

Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. Balance sheets include recording a cost of goods sold journal entry assets, liabilities, and shareholders’ equity. Assets are what the company owns, while liabilities are what the company owes. Shareholders’ equity is the portion of the business that is owned by the shareholders.

Shareholder’s Equity

Financial strength ratios can include the working capital and debt-to-equity ratios. Financial strength ratios can provide investors with ideas of how financially stable the company is and whether it finances itself. Financial ratio analysis is the main technique to analyze the information contained within a balance sheet. Line items in this section include common stocks, preferred stocks, share capital, treasury stocks, and retained earnings. Again, these should be organized into both line items and total liabilities.

In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business. If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for. Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems. After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares. This business transaction increases company cash and increases equity by the same amount.

Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds. If the company wanted to, it could pay out all of that money to its shareholders through dividends. However, the company typically reinvests the money into the company. Shareholders’ equity belongs to the shareholders, whether public or private owners.