The first step in calculating overtime pay under FLSA requirements is to determine whether an employee is classified as exempt or non-exempt. Although calculating overtime pay for non-salaried employees is a simple task, if you’d like to simplify this process further, then the following calculator is the choice for you. By consistently tracking your overtime hours and earnings with the calculator, you can determine how much overtime contributes to your annual income. This helps evaluate whether the compensation aligns with your expectations and the sacrifices required for those extra hours. This tool allows you to enter various pay rates and hours worked over multiple weeks or months, so you can track your overtime earnings trend.

- If it looks like you’ll earn just as much by doing overtimework, then don’t do it.

- One practical way of increasing savings is to put in more work for more pay.

- So, always try to remain up to date with federal and state laws and regulations.

- Once the regular rate of pay and the number of overtime hours are determined, calculate the overtime pay.

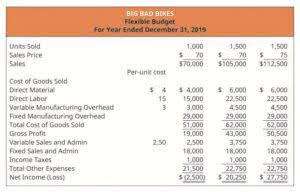

Detailed Overtime Calculator for non-salaried employees

If you are paid by the hour, you can calculate your double pay by multiplying your hourly rate by 2. If employees do not receive the overtime pay they are entitled to, they can file Bookkeeping for Chiropractors a complaint with the Labour Department of Malaysia. High turnover rates increase costs for hiring and training new staff. Keep your employees happy with fair wages, regular feedback, and growth opportunities. Use tools to forecast busy times and schedule staff accordingly. Cross-train employees so they can handle multiple roles when needed.

How to Set Up a Double Time Policy

- Consider conducting training sessions to explain the policy, answer questions, and ensure understanding.

- Some states may have different overtime thresholds or rates, and certain industries may have unique regulations.

- Since California overtime law has its own specific conditions, it’s wise to have a separate calculator on the ready.

- Don’t leave your overtime earnings to chance, use the calculator to empower yourself with knowledge and get the most out of your extra hours.

- However, it’s important to note that overtime calculation methods vary by region and industry.

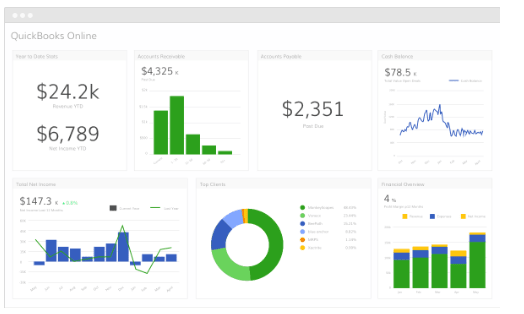

By visualizing this accounting data, you can make informed decisions about your workload and financial planning. Employees who are paid by the hour and don’t have special job duties that exempt them are usually entitled to overtime. According to the Fair Labor Standards Act (FLSA), nonexempt, covered employees are entitled to overtime compensation for hours worked over 40 in a workweek. In many cases, salaried employees are exempt from overtime, but there are exceptions based on job role, salary level, and working hours.

Total regular pay

- This reduces fixed costs while giving you the flexibility to adjust your workforce as needed.

- Always check your local labor laws and regulations to understand whether your job is exempt from overtime pay.

- It encompasses time tracking, billing, invoicing, team management, and reporting, all in one.

- This way, you only pay for the services when needed and save on benefits and taxes.

- Our mission is to demystify the intricacies of immigration laws, visa procedures, and travel information, making them accessible and understandable for everyone.

- Some states may have provisions for daily overtime or other variations.

- You might want to see how changing your overtime hours affects your overall pay.

Consider conducting training sessions to explain the policy, answer questions, and ensure understanding. With the right compensation strategy, your organization can gain these benefits. Salary.com’s Competitive Pay Assessment shows how your base and total cash compensation compare to the market. Armed with that information, you can tweak the schedule — who works when — so that each shift how much is overtime pay is covered without anyone having to work overtime.

- If you are paid by the hour, you can calculate your double pay by multiplying your hourly rate by 2.

- To calculate overtime during a holiday, you should consider both the extra hours worked and if there’s any special holiday pay rate.

- Select your preferred pay period (weekly, bi-weekly, or monthly) and currency, and the calculator will instantly display your results.

- Finally, learn to keep track of your expenses and save yourincome wisely.

- Let’s take a look at what the overtime entitlements are in the U.S. and how they can vary by state…

If you have any problems using our calculator tool, please contact us. Let’s take a look at what the overtime entitlements are in the U.S. and how they can vary by state…